November 08, 2019 |

Continental Intends to Spin Off Vitesco & 3Q Financials

- The spin-off of the powertrain business could be approved at the Annual Shareholders’ Meeting at the end of April 2020; plans for a partial IPO would no longer be pursued

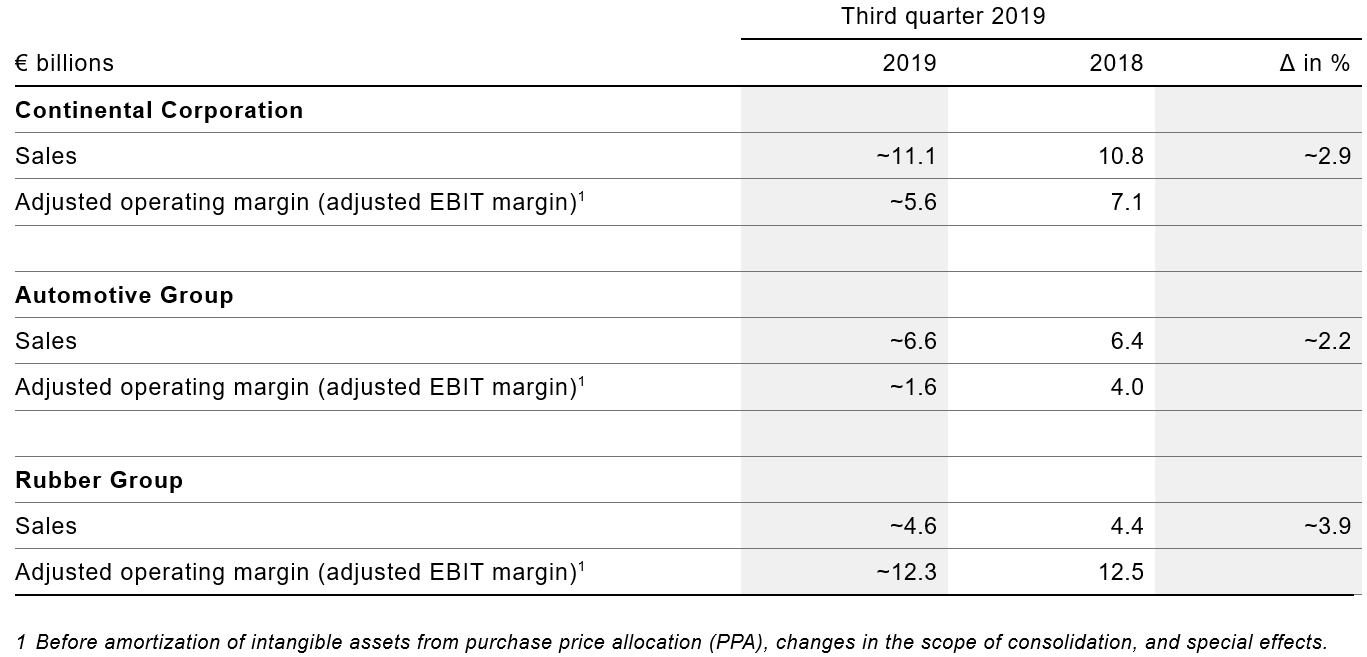

- Key figures for the third quarter of 2019 were in line with expectations; annual outlook confirmed

- Sales in the third quarter were at about €11.1 billion; adjusted EBIT margin was about 5.6 percent

- Adjusted market assumptions resulted in non-cash impairments of about €2.5 billion in the third quarter

- Impairments and provisions resulted in a negative reported EBIT and net income in the third quarter and a negative net income for 2019

- Key elements of the 2019 outlook were confirmed

- No material influence on the dividend proposal for fiscal year 2019 was expected

Hanover, October 22nd, 2019. The Executive Board of Continental decided to fully spin off its powertrain business Vitesco Technologies (Powertrain division) with a subsequent listing. The company is thus taking the offensive and tackling the accelerating trend towards powertrain electrification. It is also reacting to the, at present, largely unpredictable conditions for a potential partial IPO in 2020. Continental will therefore no longer pursue the preparation of a potential partial IPO of its powertrain operations, which had originally been considered. Subject to the approval of the Supervisory Board of Continental AG, the spin-off of Vitesco Technologies shall be submitted for a decision at the Annual Shareholders’ Meeting on April 30th, 2020. It could then take effect within the same year.

“In the coming year, our powertrain business should be given the independence and flexibility it needs for further growth. We firmly believe that, in this way, Vitesco Technologies can continue on its promising and profitable course for the future and assume a leading role in the dynamic market environment for drivetrain technologies,” said Continental CEO Dr. Elmar Degenhart, explaining the decision of the Executive Board.

“Our goal is clean and sustainable mobility. It is therefore natural that we make the heart of every vehicle – its drive system – electric. Subject to the approval of the Supervisory Board, we will have clarity about the path forward and will be able to concentrate on the future. Vitesco Technologies is already a pioneer in the field of electrification. We are very well prepared to capitalizse on the transition from combustion drives to electric mobility and the corresponding opportunities for growth,” said Vitesco Technologies CEO Andreas Wolf.

Preliminary key figures for third quarter of 2019 confirm expectations

The DAX company also released its preliminary key figures for the third quarter of 2019, which met current analyst expectations. Consolidated sales in the third quarter were at about €11.1 billion and the adjusted EBIT margin was about 5.6 percent. Sales in the Automotive Group were about €6.6 billion, with an adjusted EBIT margin of about 1.6 percent. This figure included the provisions for warranty claims of €187 million announced in July 2019. Sales in the Rubber Group were about €4.6 billion and the adjusted EBIT margin was about 12.3 percent.

“Considering the unresolved trade disputes, the unclear situation regarding Brexit, and declining markets, we did reasonably well in the third quarter from an operational standpoint. We thus confirm our annual outlook for sales, adjusted EBIT and free cash flow before acquisitions,” said Continental’s CFO Wolfgang Schäfer, commenting on the key data. He added: “We do not anticipate that global production of passenger cars and light commercial vehicles will experience any material improvement in the next five years, so we have revised our assumptions for the medium-term market development accordingly.”

The assumptions made and adapted as part of the annual planning process, led to non-cash impairments of goodwill and other intangible assets totalling about €2.5 billion, which were recognised in the third quarter of 2019. The main reason for this revaluation, which is required by accounting standards, was the revision of market expectations. Furthermore, there were changes in various assumptions, including the assumed long-term growth rates and the discount rate used.

In addition, Continental recognised provisions of €97 million in the first nine months of 2019, which were incurred in the scope of the “Transformation 2019 to 2029” structural program announced on September 25th, 2019. Further expenses for restructuring provisions related to this program are expected to be recognised in the fourth quarter of 2019, though the amounts have not yet been clarified.

“Continental has a very sound balance sheet, and it should stay that way in the future. Our structural program will help ensure that. We do not anticipate any material influence on the setting of the dividend for fiscal 2019 as a result of the impairments and expenses. These two special effects will not have an effect on the main elements of our outlook such as the adjusted EBIT, which describes our operating performance,” said Schäfer.

The significant portion of the impairments resulted from the revaluation of goodwill, which primarily stemmed from acquisitions made before 2008. The impairments affect the divisions as follows: Chassis & Safety €724 million, Interiors €1.537 billion, and Powertrains €244 million.

The impairments and the restructuring provisions were classified as special effects, and as such, did not have any effect on the adjusted EBIT, which was adjusted for special effects. The reported EBIT, the net income attributable to shareholders of the parent, as well as the equity and gearing ratios were unaffected by these adjustments. The amount of negative special effects anticipated in 2019 will thus also rise to at least €2.8 billion. The expected tax rate will continue to be at about 27 percent, which will not include the effects of the impairments, but does include the tax effects from the organisational separation of Vitesco Technologies.

Source: Continental

We’ve matched your registration number Sorry, we couldn’t find a match for registration number !